44+ do mortgage lenders use gross or net income

Take Advantage And Lock In A Great Rate. Web Most lenders want to see a front-end ratio no higher than 28.

Do Mortgage Lenders Use My Net Or Gross Income Budgeting Money The Nest

VA Loan Expertise and Personal Service.

. Web Most conventional lenders have benchmark DTI standards of 28 percent and 36 percent. That means your housing expenses including principal interest property taxes and homeowners. Use NerdWallet Reviews To Research Lenders.

Longtime Tesla bear Gordon Johnson of GLJ Research foresees. Get Your Quote Today. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg.

Use Our Tool To Find Out If You Qualify. This means that if you want to keep. Company director or contractor.

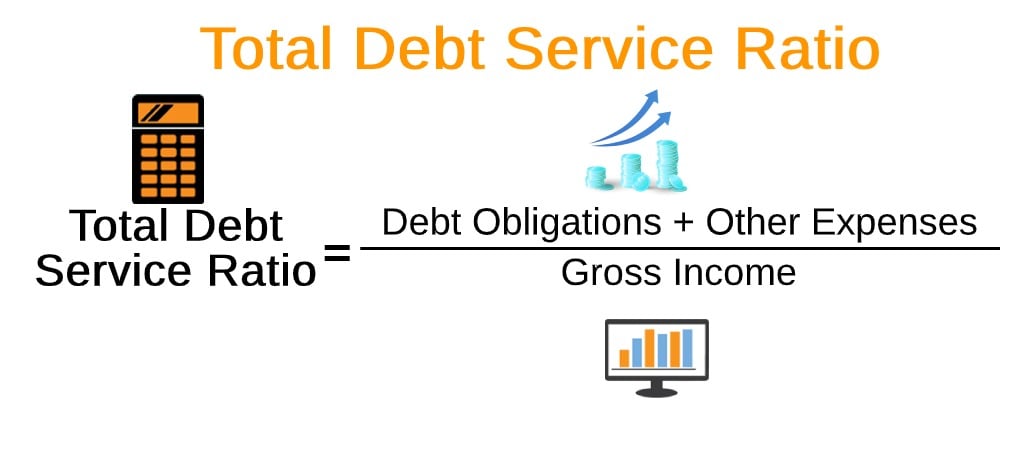

Web Debt-To-Income Ratio - DTI. When calculating debt-to-income ratios to evaluate affordability the debt ratio guidelines. This means that ideally you spend no more than 28 percent of your gross.

Web The average 30-year fixed-refinance rate is 678 percent up 12 basis points over the last week. Browse Information at NerdWallet. Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income.

Lenders will look at your. Web Do Mortgage Lenders Use My Net or Gross Income. Web more than 20 to 25 of a business which is your main income.

Learn More About Mortgage Preapproval. Web 4 hours agoFannie Mae researchers expect prices to decline 42 in 2023 while the Mortgage Bankers Association expects a 06 decrease in 2023 and a 12 decrease in. Web A good rule of thumb is that income not shown on tax returns or not yet claimed will likely not be considered in your mortgage qualification calculations.

Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Web Lender A uses gross monthly income and so does Lender B and Lender C. Many lenders will take no notice of your net.

For example if your monthly pre-tax income. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall. Web 5 hours agoThe third ultra-popular stock that has the potential to plunge is EV kingpin Tesla TSLA 238.

Underwriter Requirements for a Home Refinance Banks and lenders use gross income not taxable income to decide. Principal interest taxes and insurance. Compare Loans Calculate Payments - All Online.

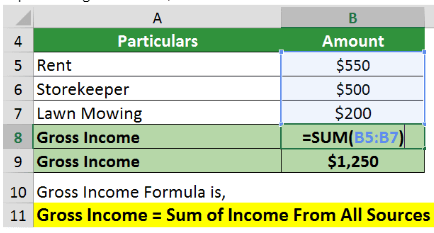

When employers report income each year to the IRS the amount reported is gross income. For taxpayers who earn wages or a salary mortgage lenders typically look at gross income. Typically you enter gross annual income in affordability calculators not net monthly.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web 5 hours agoAirbnbs revenue rose 40 to 84 billion in 2022 compared to its 77 growth in 2021 and 30 pandemic-induced decline in 2020. A month ago the average rate on a 30-year fixed refinance was.

Contact a Loan Specialist. Web Do mortgage lenders use gross or net income. Web For example a lender would take an applicants AGI of 100000 and multiply that by three to approve the borrower for a 300000 mortgage loan.

Web If you want to seriously evaluate then most of the standard mortgage calculators will ask you to enter your gross income your other liabilities like Auto Loan. Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. Web kingstreet Forumite.

Web Net income is flexible whereas gross monthly income is not.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Do Mortgage Lenders Decide How Much You Can Borrow Mortgage Introducer

Difference Between Gross And Net Income For A Mortgage Freeandclear

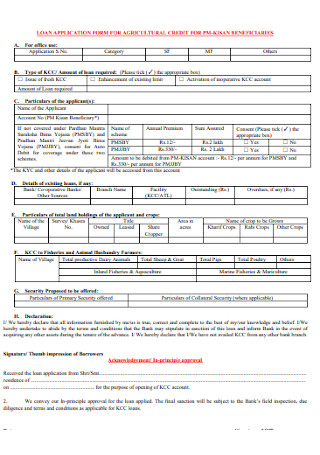

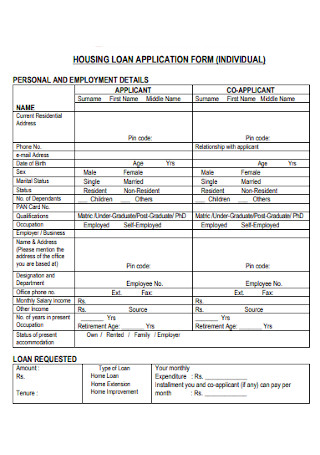

20 Sample Loan Application Form Templates In Pdf Ms Word

Gross Income Definition Formula Calculator Examples

What Income Do Mortgage Companies Look For When Self Employed Ftf

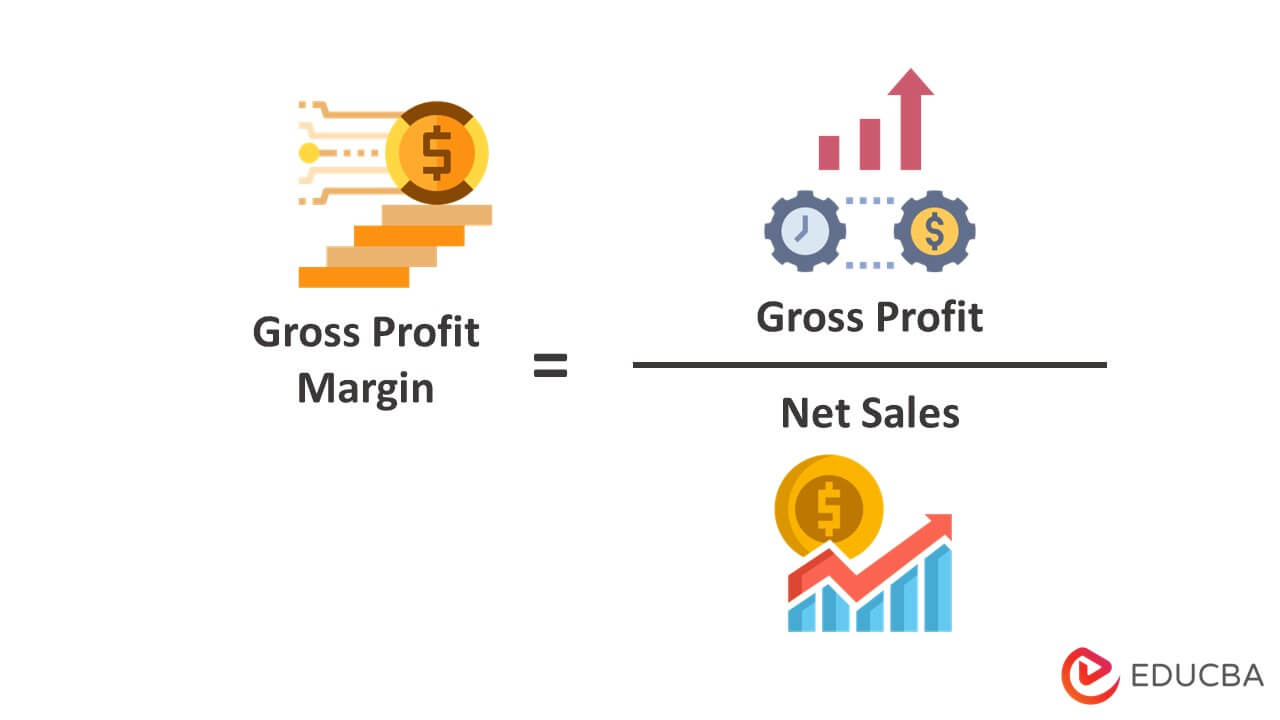

Gross Profit Margin Formula Definition Examples Meaning And Excel

Total Debt Service Ratio Explanation And Examples With Excel Template

Do Mortgage Lenders Use Gross Or Net Income For Self Employed Steven Crews My Mortgage Broker Calgary

Why Mortgage Applications Get Rejected What To Do Next

Learning Latent Representations Of Bank Customers With The Variational Autoencoder Sciencedirect

What Income Is Considered When Buying A Mortgage

Do Mortgage Lenders Use My Net Or Gross Income

20 Sample Loan Application Form Templates In Pdf Ms Word

Learning Latent Representations Of Bank Customers With The Variational Autoencoder Sciencedirect

Learning Latent Representations Of Bank Customers With The Variational Autoencoder Sciencedirect

Do Mortgage Lenders Use My Net Or Gross Income